Need car loans in Melbourne? We’ll help you save thousands on your car loan!

Navigating car finance options can be confusing, with so many terms, hidden fees and the risk of damaging your credit score.

If you choose the wrong car loan you can end up paying more than you need, and potentially get locked into bad financial commitments.

Instead of worrying about car finance, imagine driving off in your new car knowing have an awesome loan. That’s what we do!

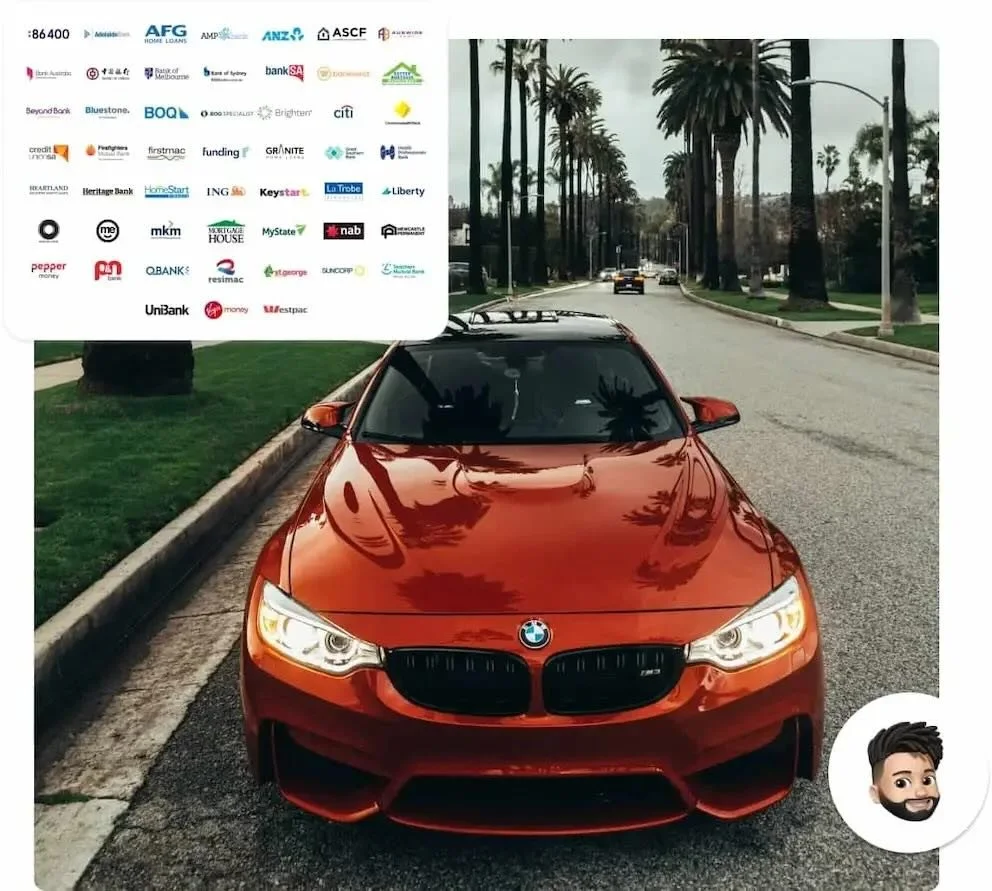

At Naked Loans, we compare 30+ lenders to get you the best car finance in Melbourne. Best of all, our service is completely free! We are paid by the lender you choose, meaning you have no out of pocket cost.

Ready to get a great car loan? Enquire online today!

Rated 4.9 out of 5 by hundreds of customers, with a 95% loan approval rate.

How We Help You Secure the Best Car Finance in Melbourne?

Get the best rates.

We compare from over 30 lenders to find the best car finance that suits your needs. Let us do the hard work, so you can enjoy the best rates available.

Super fast approval.

Get approved for a great car loan in as little as 48 hours. Our streamlined process ensures you’re on the road faster without the hassle.

Award winning support.

Our experts provide personalised advice to help you choose the best finance options and features that work for your unique situation.

Protect your credit score.

Explore loan options without impacting your credit score. Unlike going directly to lenders, we use a soft credit check that won’t harm your rating.

Car Finance Melbourne: Our 4 Step Process

1. Application

Enquire online in less than a minute to connect with a car loan broker. We’ll offer a free, no-obligation consultation to go over your financial situation and explore your best options.

2. Assessment

We prepare your car loan application and submit it to the lender. Once approved, you select your vehicle, and we forward the invoice to the lender.

3. Contract

You review your loan terms and repayment options. When satisfied, you sign the contract, and we handle the paperwork before sending it back to the lender for settlement.

4. Settlement

The lender finalises the contract, and we receive the settlement advice, which we share with you and the vendor. Then, you can celebrate your new car loan!

Access to 30+ different lenders

With Naked Loans, you’re not limited to one or two finance options. We give you access to a network of over 30 trusted lenders, ensuring you can compare options and find the perfect car finance in Melbourne option that suits your needs, with a low car loan interest rate and great terms.

More options mean more chances to save on your car loan. Ready to get a great Melbourne car loan? Send us a free finance enquiry today!

Melbourne Car Finance FAQ

-

Absolutely! If you’re in Melbourne and seeking a loan for a used car or a pre owned vehicle, Naked Loans can help you find a financing solution that fits your needs.

-

A fixed rate loan is a car loan where the interest rate remains unchanged for the entire duration of the loan.

This ensures that your monthly repayments remain constant, making it easier to manage your budget and plan your finances.

Fixed-rate loans provide peace of mind since you’re shielded from changes in interest rates, meaning your loan’s interest rate stays the same even if market rates increase. This stability makes fixed-rate loans a popular option for many borrowers.

In contrast, a variable rate loan has an interest rate that fluctuates over time based on market conditions. As a result, your monthly payments may rise or fall.

Although variable rate loans often begin with lower interest rates, they come with the risk of higher costs if rates go up.tion

-

Absolutely! We specialise in helping individuals with bad credit secure car loans.

Click here to learn more about bad credit car loans and how we can help.

-

As a car finance brokers, we specialise in vehicle finance. Whilst we can provide general advice, we don't offer services for a:

Personal loan

Home loan

Business loans

Corporate lending

Asset finance

However, we can connect you with a partners who can help you out such as a mortgage broker or a broker for business loans.

We may be able to help you with equipment finance depending on your needs.

-

When exploring a personal car loan, you’ll likely encounter the terms “secured” and “unsecured.”

A secured car loan uses the vehicle you’re purchasing as collateral. This means that if you don’t keep up with your loan payments, the lender has the right to repossess the car to recover the debt.

Secured loans generally come with lower interest rates because they present less risk to the lender.

An unsecured loan, by contrast, doesn’t require any collateral. Since the lender has no asset to claim if you default, these loans tend to have higher interest rates.

An unsecured car loan could be a good option if you don’t want to risk losing your car or if you’re purchasing an older vehicle that wouldn’t qualify as collateral.

(This concept also applies to secured and unsecured personal loans).

-

Yes, the minimum loan amount is $5000.

We provide car loans for up to $100,000.

-

Sure do! To help you run the numbers for your Melbourne car finance, click here to open our car loan calculator.

-

We help you get a vehicle loan for both used cars and new car finance. We can also help with:

Motorbike loans

Truck finance

Caravan loans

Boat finance

Business vehicle finance

Secured car loans

-

Since we're an online car loan broker, we don't have a physical office in Melbourne.

However, we help Australians all over the country, including heaps of Melbourne and South Melbourne locals. We'd love to help you too!